Something extraordinary is happening in global markets right now.

Central banks are hoarding it, billionaires are betting on it, and even casual investors can’t stop talking about it. No — it’s not Bitcoin this time.

It’s gold.

The shiny metal that once defined wealth for civilizations is now at the center of a modern economic storm. And its underrated cousin, silver, is silently preparing for a breakout of its own.

But what’s really happening behind this global gold fever?

Why are world economies — in 2025, not 1825 — suddenly racing back to a commodity that doesn’t yield interest, pay dividends, or produce cash flow?

Let’s break it down.

1. The Return of the “Fear Trade”

Every time uncertainty grips the global economy, gold quietly climbs its throne again.

And 2025 has been uncertainty on steroids.

From escalating geopolitical tensions to currency volatility, investors are once again looking for an anchor in the storm. Gold — the timeless hedge against chaos — has become that anchor.

Central banks across Asia and the Middle East are buying gold at record levels, reducing their dependence on the U.S. dollar. It’s not just diversification; it’s de-dollarization.

Meanwhile, inflation may not dominate headlines like in 2022, but its lingering effects still haunt currencies and savings. The cost of living is rising faster than interest rates can compensate — pushing both institutions and individuals toward real assets that can’t be printed or devalued overnight.

Gold’s value proposition suddenly feels timeless again:

“In a world of uncertainty, certainty shines.”

2. The Dollar Weakness & Interest Rate Domino Effect

Gold and the U.S. dollar share a complicated relationship — one goes up, the other usually goes down.

The Federal Reserve’s shift toward interest rate cuts has sparked a domino effect across the global economy. Lower yields make holding cash or bonds less rewarding. Investors don’t want “safe” returns that barely outpace inflation — they want assets with staying power.

And gold, with its finite supply and global acceptance, checks every box.

As U.S. rates move lower, the dollar weakens, making gold cheaper for other countries to buy. This creates a global feedback loop of demand — a cycle we’re witnessing right now.

In short:

- Lower interest rates → weaker dollar

- Weaker dollar → stronger gold

- Stronger gold → renewed investor enthusiasm

That’s how a silent rally turns into a global movement.

3. Central Banks Are Quietly Rewriting the Rules

If you think gold demand is just retail hype, think again.

This wave started at the top.

According to Reuters, global central banks purchased more than 1,000 tonnes of gold in the past year, marking one of the highest buying sprees in modern history.

Why? Because even governments don’t fully trust fiat currencies anymore.

Many countries — especially in Asia — are diversifying away from dollar-based reserves. The U.S. debt has crossed levels that make the world uneasy. So, nations like China, India, and Russia are turning to gold to backstop their currencies and stabilize reserves.

This is a massive structural shift — one that quietly underpins gold’s bullish momentum for the next decade.

4. The Silver Story: The Metal Everyone’s Undervaluing

While gold steals the spotlight, silver is quietly building the foundation for its own rally.

Silver isn’t just a “poor man’s gold” anymore — it’s an industrial powerhouse.

From solar panels and electric vehicles to advanced electronics, silver plays a key role in the global green revolution.

Here’s what’s driving silver’s momentum in 2025:

- Surging industrial demand: Renewable energy projects and EV production are accelerating.

- Supply constraints: Global mining output isn’t keeping up with demand.

- Historical undervaluation: The gold-to-silver ratio remains far above its long-term average — a signal that silver could outperform gold in the next phase.

If gold is the “fear trade,” silver is the “growth trade.”

And when both fear and growth drive capital in the same direction… that’s when markets truly ignite.

5. Investor Psychology: FOMO Meets Fundamentals

Let’s be honest — gold isn’t new.

It’s been mankind’s favorite asset for over 5,000 years. But what’s different this time is the digital access and global awareness around it.

Social media, financial news, and fintech apps have turned gold from a quiet hedge into a mainstream narrative.

Retail investors are no longer buying jewelry — they’re buying exposure through trading platforms, ETFs, and derivatives.

Every breakout headline fuels a new wave of FOMO (Fear of Missing Out).

And as more people pile in, institutions follow suit to protect portfolios.

Momentum attracts more momentum — until the trend becomes unstoppable.

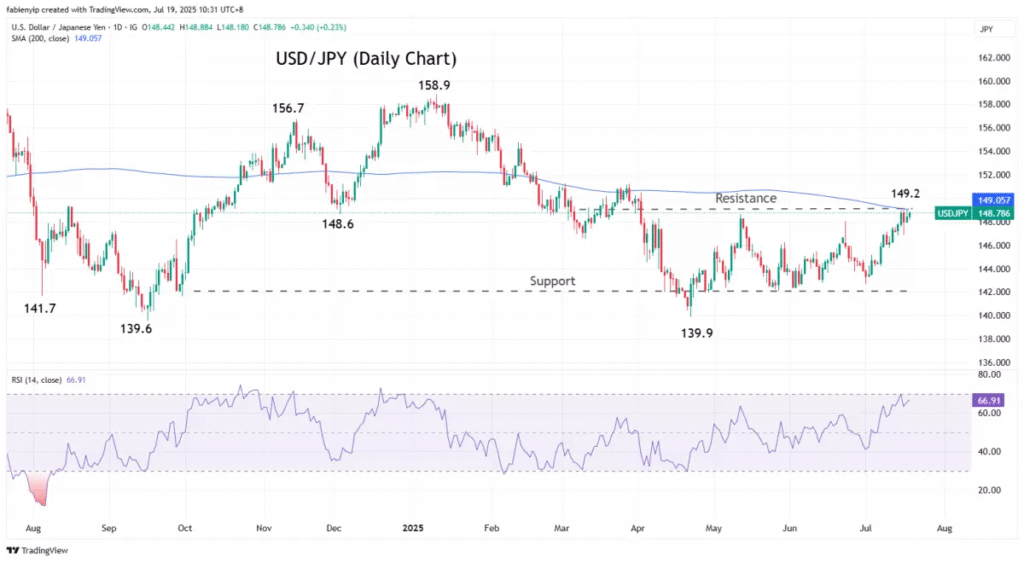

6. What This Means for Traders

For traders, this gold and silver boom isn’t just a story — it’s an opportunity.

Volatility is high, liquidity is strong, and prices are moving with conviction. Whether you’re a short-term scalper or a long-term investor, precious metals are providing setups across all timeframes.

And this is where Giraffe Markets comes in.

With access to spot metals, CFDs, and global commodities, Giraffe Markets allows traders to seize opportunities in both rising and falling markets. You don’t have to own physical gold to benefit — you can trade its price movements directly through advanced platforms like MT5, with lightning-fast execution and transparent spreads.

In other words:

You can trade the global gold rush from your screen.

7. The Smart Play for 2025

Here’s what the world’s smartest investors are doing right now — and what you should be watching too:

- Monitoring central bank actions: Their gold purchases often signal the next leg up.

- Tracking U.S. rate decisions: Fed cuts usually mean higher gold.

- Watching the gold-to-silver ratio: If the ratio falls, silver’s strength is catching up.

- Staying flexible: Both metals are trending, but volatility remains. Manage risk wisely.

The most successful traders in 2025 won’t just be those who predict prices — they’ll be the ones who position themselves early and use the right platforms to capitalize when the world catches on.

8. Final Thought: History’s Repeating — But Smarter Traders Are Ready

Gold isn’t just a metal — it’s a mirror reflecting how the world feels about risk, trust, and the future.

And right now, that mirror is glowing brighter than ever.

Every major financial shift in history — from currency crises to tech bubbles — has one constant: smart money flows into safety before the crowd realizes why.

So when the world rushes to gold and whispers about silver’s next move…

It’s not random hype. It’s the market telling you something.

The question is: are you listening?

Trade the Gold and Silver Momentum on Giraffe Markets

Join thousands of traders across 90+ countries already taking advantage of this metals boom.

With competitive spreads, advanced MT5 trading tools, and real-time insights, Giraffe Markets helps you stay one step ahead in the world’s most liquid markets.