Master FX currency fluctuations. Learn effective hedging strategies for dynamic forex markets. Start trading & make informed forex trades on any platform.

Navigating the Complex World of Forex Trading: An Expert Guide to Currency Fluctuations, Hedging Strategies, and Market Dynamics

Understanding Forex Trading

Forex trading, also known as foreign exchange trading, involves the buying and selling of currencies in the global marketplace. It operates 24 hours a day, five days a week, and is one of the largest financial markets in the world.

How Forex Trading Works

In forex trading, currency pairs are quoted, such as EUR/USD or GBP/JPY. Traders speculate on the price movements of these pairs, aiming to profit from fluctuations in exchange rates. The market is influenced by various factors, including economic indicators, geopolitical events, and market sentiment.

Benefits of Forex Trading

- High Liquidity: The forex market is highly liquid, allowing for quick entry and exit of trades.

- Leverage: Traders can use leverage to control larger positions with a smaller amount of capital.

- Accessibility: Forex trading is accessible to individual traders, requiring only a small deposit to start.

Risks Involved in Forex Trading

While forex trading offers the potential for high returns, it also comes with significant risks. Market volatility can lead to substantial losses, and leverage can amplify these risks. It is essential for traders to employ risk management strategies and have a solid trading plan.

Getting Started with Forex Trading

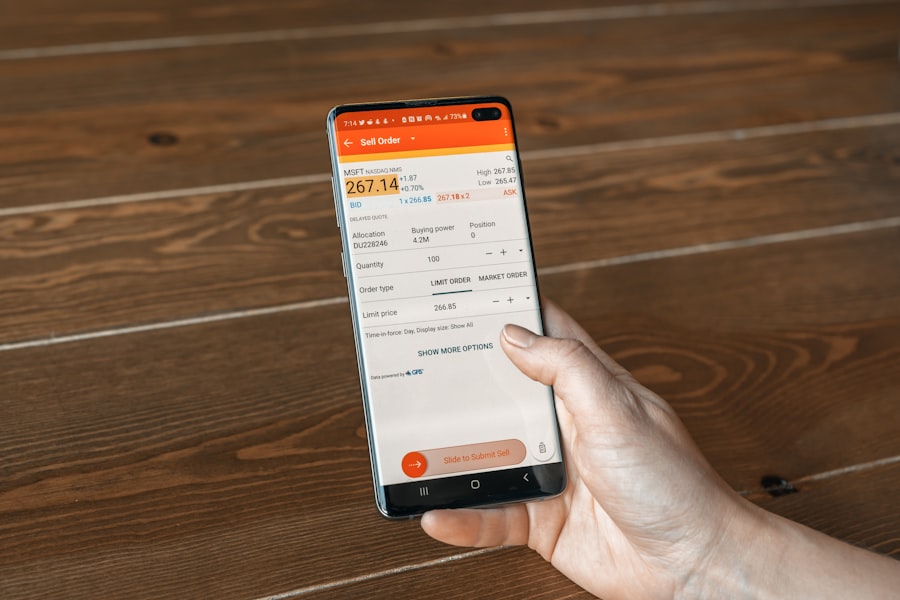

To begin trading forex, one must choose a reliable broker, open a trading account, and develop a trading strategy. It is advisable to practice with a demo account before committing real money to understand the market dynamics and refine trading skills.

Conclusion

Forex trading presents opportunities for profit but requires knowledge and discipline. By understanding the market and implementing sound strategies, traders can navigate the complexities of forex trading effectively.

Welcome, fellow forex enthusiasts! At Giraffe Markets, we understand that the foreign exchange market can be as exhilarating as it is daunting. With trillions of dollars in daily trades, it’s a world brimming with opportunities—one that rewards knowledge and strategy. As experts in the field of forex trading, we’re here to guide you through the complexities of trading platforms and strategies. So, grab a cup of your favorite brew, sit back, and let’s dive into the fascinating intricacies of currency fluctuations, hedging strategies, market dynamics, and more.

Understanding Currency Fluctuations

At the heart of forex trading lies the ebb and flow of currency values, which can significantly impact the currency price. Currency fluctuations are inevitable and driven by numerous factors ranging from geopolitical events to economic data releases. As a trader, understanding these movements is crucial to making informed trading decisions.

1. Familiarity with these determinants will enhance your ability to trade forex online. Supply and Demand: Currency values are dictated by market supply and demand. If traders and investors expect a currency to strengthen, such as the US dollar, demand will rise, pushing up prices in the forex market. Conversely, a negative outlook can lead to a sell-off, depleting its value. Stay tuned to central bank actions, as they directly influence supply and demand through interest rate decisions and monetary policy machinations, particularly during active trading sessions.

2. Understanding the types of forex transactions can help in navigating the market effectively. Economic Indicators: Economic health is a primary driver of currency strength and can significantly impact major currencies. Indicators such as GDP growth rates, employment figures, and inflation statistics paint a picture of economic wellbeing. For instance, a robust jobs report in the United States might buoy the USD as stronger employment signifies a healthy economy, appealing to investors worldwide who buy and sell currency pairs in online forex trading.

3. Political Stability in the context of forex trading online can significantly impact currency values. Geopolitical events can send shockwaves through currency markets. Elections, policy changes, or international conflicts make headlines, and often, these events are catalysts for currency volatility in speculative trading. As a trader, staying informed about global political developments is not just advisable; it’s essential.

Mastering Hedging Strategies

Once you’re versed in the mechanisms behind currency fluctuations, the next logical step is to safeguard your investments. Hedging strategies provide insurance against market volatility. They’re your shield against unexpected economic storms.

1. Forward Contracts are agreements to buy or sell a currency at a predetermined price on a specific future date, often used in fx trading. A staple in hedging, forward contracts allow you to lock in a current exchange rate for a future date in the forex trading platform landscape. This is particularly useful for businesses looking to stabilize costs in foreign operations. It’s a form of protection against adverse currency movements, ensuring that you are not left at the mercy of unforeseen fluctuations.

2. Options Trading: Options give you the choice, but not the obligation, to exchange currency at a predetermined rate before an expiry date in the fx market, enhancing your trading experience. As a trader, options offer flexibility akin to having a safety net without forfeiting potential upside gains in the fx trading arena. They’re perfect for those looking to manage risk while exploring opportunities for profit.

3. Currency Swaps: Useful for businesses and financial institutions, swaps involve exchanging principal and interest payments in one currency for the same in another currency. This complex but effective strategy helps manage foreign exposure and can be tailored to cap risks from interest rate changes when you trade forex pairs.

Grasping Market Dynamics

The forex market, being the liquid powerhouse it is, exhibits distinct dynamics that reflect global economic conditions, especially when the forex market is open. Understanding market mechanics is pivotal in navigating this ever-shifting landscape of exchange trading and how the market works.

1. Market Hours and Sessions: Forex operates 24 hours a day, opening doors to diverse trading opportunities across three major sessions: Asian, European, and North American, making it ideal for start forex trading, but be aware that accounts lose money when trading. Each trading session is marked by its own level of activity and volatility, influencing traders’ strategies. Knowing when to trade is just as important as knowing how to trade in the context of online trading.

2. Transient Trends vs. daily trading volume are important metrics to consider when you trade forex online. Lasting Trends: Distinguishing between short-lived fluctuations and long-term trends can elevate your trading game. Technical analysis tools such as moving averages and trend lines are invaluable in spotting these patterns for day trading and swing trading.

3. Leverage and Margin: Take control of your trading with effective leverage and margin strategies. Leverage allows you to control a large position with a small amount of capital. While this can amplify profits, it also magnifies losses, making it a double-edged sword. Understanding and managing your leverage ratio is essential for sustainability in forex trading with a reliable forex broker.

Navigating Financial Instruments

At Giraffe Markets, we believe in the power of diverse financial instruments. Forex trading, though centered on currency pairs, offers an array of instruments that traders can leverage to their advantage.

1. Currency Pairs are essential components in the global forex market. The essence of forex trading, currency pairs, are split into major, minor, and exotic categories that traders can buy and sell. Understanding which category fits your risk appetite and trading strategy is paramount in the context of trading accounts. Major forex pairs like EUR/USD enjoy high liquidity and tighter spreads, while exotic pairs might offer higher profits but demand greater caution due to volatility in trade volume in the fx market.

2. Exchange-Traded Funds (ETFs) are popular among forex traders for diversifying their portfolios. For those looking to diversify beyond traditional forex, currency ETFs offer exposure to currency movements but with the added stability of a fund structure, making them a viable option in foreign exchange trading. Exchange-traded products are ideal for investors wanting to reduce risk while tapping into currency trends, especially when considering gold and XAUUSD.

3. Futures and CFDs: Currency futures and Contracts for Difference (CFDs) are advanced trading instruments. Both allow speculation on an underlying currency’s future price movements without owning the actual currency, a key aspect of online forex trading. While potentially profitable, trading forex requires intricate understanding and is best suited for seasoned traders who can navigate market fluctuations.

Decoding Exchange Rates

Exchange rates are the backbone of forex markets, influencing everything from travel expenses to the cost of imports and exports in the currency trade, particularly in the dynamic world of fx trading. Mastering exchange rates is akin to understanding the pulse of global commerce.

1. Determinants of Exchange Rates: These factors are critical for anyone looking to trade the forex effectively. Exchange rates are affected by an amalgamation of interest rates, inflation, and economic stability, all of which are crucial for successful currency trades. Higher interest rates offer lenders a higher return compared to other countries, thus attracting foreign capital and causing the exchange rate to rise.

2. Spot vs. forward rates are critical concepts to understand for anyone looking to trade forex effectively. Forward Exchange Rates play a crucial role in fx trading strategies that help manage future currency price fluctuations in the context of leverage in forex. While spot rates denote current exchange values applicable to immediate transactions in the forex market, forward rates are used for currency trades that will occur at a future date. Understanding this distinction aids in better strategic planning for online trading activities.

3. Real vs. Nominal Exchange Rates: While nominal exchange rates are the price at which two currencies can be exchanged, real exchange rates account for changes in price levels between countries. This differentiation is crucial for more accurate assessment of currency strength.

Unpacking Economic Indicators

Economic indicators act as market barometers, providing foresight into a country’s financial health, which is essential for leveraged trading and understanding why many accounts lose money when trading CFDs. Being adept at reading these signals can substantially boost your trading acumen in various types of forex.

1. Gross Domestic Product (GDP): GDP measures the total economic output and growth, which can influence the dynamics of trading CFDs. A rising GDP usually indicates a strengthening economy, often positively impacting the home currency, which is crucial for those who want to take control of your trading.

2. Consumer Price Index (CPI) is often analyzed in the context of global forex trends and is crucial for developing effective forex trading strategies. As a measure of inflation, the CPI can influence central bank interest rate decisions, which in turn affect forex trading work. Higher inflation typically leads to higher interest rates, supporting currency strength.

3. Balance of Trade is a critical indicator that reflects the difference between a country’s exports and imports, influencing currency price in the forex market is open 24 hours. A country’s balance of trade affects its currency value, which is a critical factor in forex trading strategies. A trade surplus usually indicates demand for a country’s currency as foreign buyers exchange their currency for the trades. Conversely, a deficit might weigh down currency values.

The Mechanics of Foreign Exchange Markets

Finally, let’s wrap up by exploring the mechanics of forex markets themselves. From their structure to key participants, knowing who moves the market can lend you an edge in the financial market in the world.

1. Market Participants: The forex market is a collective cosmos of banks, corporations, governments, and individual traders, all navigating their trading needs. Understanding the role of each can highlight how markets might react under different scenarios in forex trading explained.

2. Over-the-Counter Nature: This is a key aspect of how forex is traded and can impact pricing and liquidity. Unlike centralized exchanges, forex trading online occurs over-the-counter (OTC), meaning trades are executed directly between parties. This presents both flexibility and challenges, as trading involves meticulously managing counterparty risks.

3. Regulatory Environment in the forex trading online sector is crucial for ensuring fair practices. The forex market, despite its decentralized nature, is subject to regulation. Being aware of regulatory changes and adhering to legal standards is non-negotiable for responsible trading.

Conclusion

The exhilarating journey of forex trading is paved with both opportunities and risks, especially during trading hours that are open 24 hours a day. At Giraffe Markets, our mission is to arm you with the knowledge and tools needed to start trading forex in this dynamic world of financial markets. Whether you’re intrigued by the nuances of currency fluctuations or looking to enhance your portfolio with intricate hedging strategies, education is your most valuable asset.

Remember, no two trading days are identical, and adaptive foresight distinguishes successful traders from the rest. Stay informed, stay strategic, and let the rhythm of the forex market guide your path. Until next time, happy trading!

This concludes our expert guide on forex trading, which is essential for meeting your trading needs. We hope you found this exploration as enlightening as we did in crafting it for you. Should you have any questions or topics you’d like us to delve deeper into, don’t hesitate to reach out. We’re here to elevate your trading journey.