The financial markets in 2025 are buzzing with opportunity, and the convergence of crypto trading and forex trading is at the forefront of this evolution. With global forex market volumes reaching $7.5 trillion daily and cryptocurrencies like Bitcoin and Ethereum gaining mainstream traction, traders are increasingly looking to diversify across both asset classes. At Giraffe Markets, our multi-asset platform empowers traders to seize these dual-market opportunities with advanced tools, tight spreads, and leverage up to 1:500. In this blog, we explore why combining crypto and forex trading is a game-changer in 2025, share key statistics, and show how Giraffe Markets can help you succeed.

Why Crypto and Forex Trading Are a Perfect Match in 2025

The synergy between crypto trading and forex trading lies in their shared volatility and 24/7 market access, making them ideal for traders seeking high liquidity and dynamic opportunities. Here’s why this dual-market approach is trending:

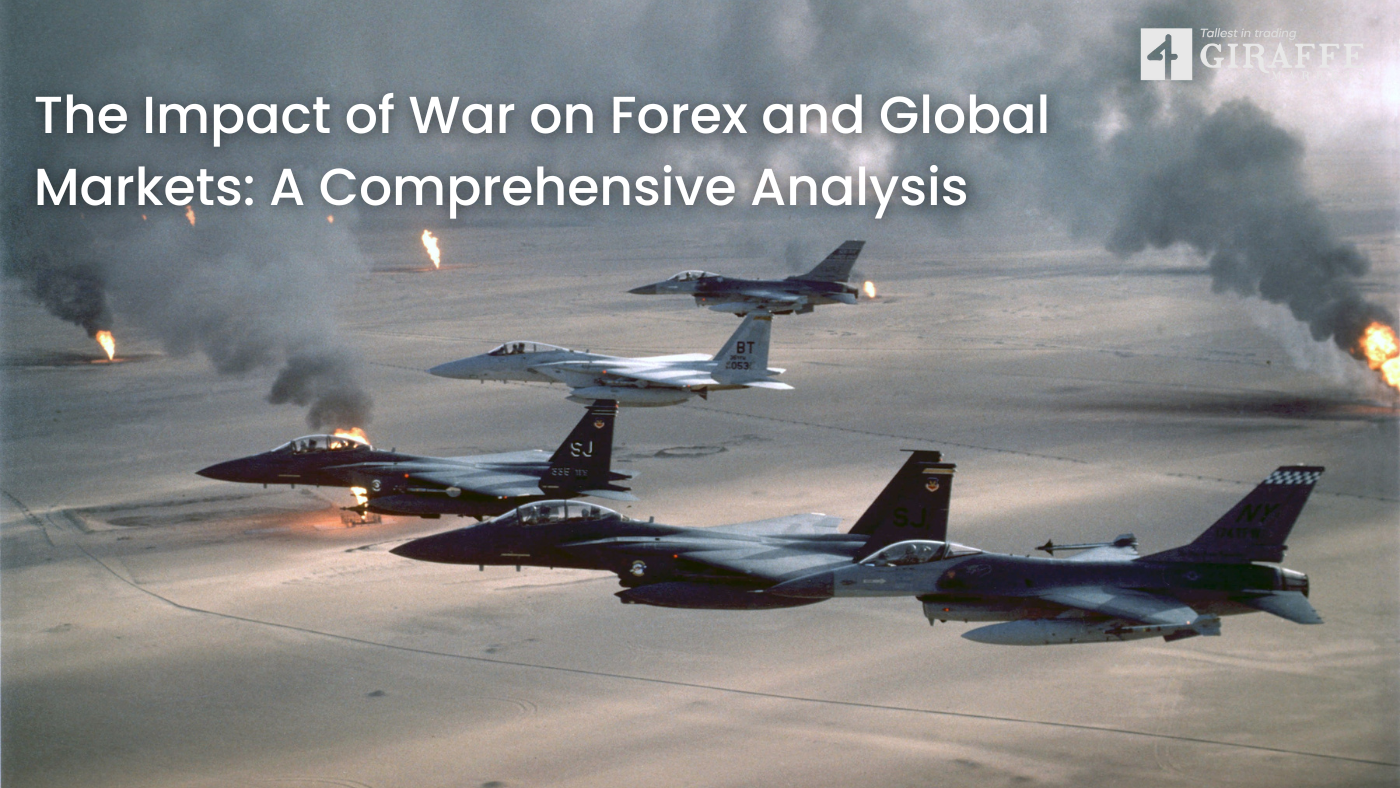

Market Volatility: Cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) are known for sharp price swings, often driven by market sentiment or global events. Similarly, forex pairs like EUR/USD or USD/JPY react to economic data and geopolitical shifts. This volatility creates opportunities for traders to profit in both markets.

Diversification: Trading both forex and crypto reduces risk by spreading exposure across uncorrelated assets. For instance, when forex markets are stable, crypto’s volatility can offer alternative trading opportunities.

AI-Driven Tools: Advancements in AI and machine learning are revolutionizing both markets. In 2025, AI systems manage approximately 68% of forex trading volume, enhancing predictive modeling and real-time analysis. Crypto trading platforms like Giraffe Markets leverage similar AI tools for smarter decision-making.

Global Accessibility: Both markets operate 24/7, allowing traders worldwide to act on opportunities anytime, unlike traditional stock markets.

At Giraffe Markets, you can trade forex pairs, cryptocurrencies, commodities, and indices from a single account, making it easier to capitalize on these synergies. Visit our crypto trading page to explore our offerings.

Key Statistics Driving Crypto and Forex Trading in 2025

To understand the potential of combining crypto and forex trading, let’s dive into some key statistics shaping these markets in 2025:

| Metric | Forex Market | Crypto Market |

|---|---|---|

| Daily Trading Volume | $7.5 trillion daily | $200 billion (Q1 2025) |

| Market Growth (2024–2025) | 8% YoY growth | 12% YoY growth (projected) |

| AI-Driven Trading Share | 68% of volume | 45% of volume (est.) |

| Popular Assets | EUR/USD, USD/JPY, GBP/USD | Bitcoin (BTC), Ethereum (ETH), Solana |

| Leverage Offered (Giraffe Markets) | Up To 1:500 | Up To 1:100 |

Forex Market Size: The global forex market’s daily turnover has surged to $7.5 trillion in 2025, driven by increased retail participation and AI automation.

Crypto Market Growth: The crypto market is projected to grow by 12% in 2025, with Bitcoin and Ethereum leading trading volumes due to institutional adoption and ETF approvals.

AI Adoption: AI tools now dominate 68% of forex trades and 45% of crypto trades, enabling faster analysis and automated strategies. Giraffe Markets integrates AI-driven tools like MetaTrader 5 (MT5) to enhance trading precision.

Strategies for Trading Crypto and Forex Together

Combining crypto trading and forex trading requires a strategic approach to maximize returns while managing risks. Here are three proven strategies to leverage both markets using Giraffe Markets’ platform:

Correlation Trading

What It Is: Analyze correlations between forex pairs and cryptocurrencies. For example, USD strength (seen in USD/JPY) often inversely affects Bitcoin prices.

How to Do It: Use Giraffe Markets’ MT5 platform to monitor real-time correlations and execute trades across both markets.

Why It Works: Correlations allow you to hedge risks and capitalize on market movements. Giraffe Markets’ tight spreads (as low as 0.1 pips) make this cost-effective.

Event-Driven Trading

What It Is: Trade based on global events like central bank announcements or crypto ETF launches.

How to Do It: Leverage Giraffe Markets’ market insights and fast execution to trade EUR/USD or BTC/USD during high-impact news.

Scalping with AI Tools

What It Is: Execute rapid, small-profit trades in both forex and crypto using AI-driven signals.

How to Do It: Use Giraffe Markets’ AI-powered MT5 indicators to identify entry/exit points. Practice on our demo account.

Case Study: How a Trader Used Giraffe Markets to Profit in Both Markets

Meet Sarah, a retail trader who joined Giraffe Markets in early 2025. During a U.S. Federal Reserve rate hike announcement, Sarah used real time data to short BTC/USD while going long on USD/JPY. Her trades yielded a 3% return in one week, thanks to tight spreads and leverage up to 1:100 for crypto. Sarah also utilized Giraffe Markets’ MT5 AI tools to automate her scalping strategy. Start your journey like Sarah at Giraffe Markets.

Why Choose Giraffe Markets for Crypto and Forex Trading?

- Multi-Asset Platform: Trade everything from one account.

- Advanced Tools: Use our MT5 platform for predictive modeling and real-time signals.

- Competitive Spreads: Spreads as low as 0.1 pips.

- High Leverage: Up to 1:500 for forex, 1:100 for crypto.

- Educational Resources: Demo accounts and education hub for beginners.

- 24/7 Support: Expert help anytime you need it.

Note: Some sources suggest Giraffe Trade Ltd may lack regulation by strict financial authorities, so verify regulatory status before trading.

Tips for Success in Dual-Market Trading

- Start with a Demo Account: Practice strategies risk-free.

- Stay Informed: Follow major events like Federal Reserve policy and ETF developments.

- Use AI Tools: Giraffe’s MT5 platform helps automate decision-making.

- Diversify Wisely: Use Giraffe’s multi-asset dashboard to balance your trades.

- Monitor Gold: It’s a classic hedge during volatility.

Frequently Asked Questions (FAQs)

Here are answers to common questions about combining crypto trading and forex trading with Giraffe Markets:

1. Can I trade both forex and crypto on the same platform with Giraffe Markets?

Yes! Giraffe Markets offers a multi-asset platform where you can trade forex pairs (e.g., EUR/USD), cryptocurrencies (e.g., BTC/USD), commodities, and indices from a single account. This streamlines your trading experience and supports diversification. Explore our platform at Giraffe Markets.

2. What are the benefits of trading crypto and forex together?

Trading both markets allows you to diversify your portfolio, hedge risks, and capitalize on volatility. For example, when forex markets are stable, crypto’s price swings offer trading opportunities. Giraffe Markets’ tight spreads and AI-driven MT5 tools help you maximize profits across both markets.

3. How does Giraffe Markets’ leverage work for crypto and forex?

Giraffe Markets offers leverage up to 1:500 for forex and 1:100 for crypto, allowing you to control larger positions with less capital. For instance, with $1,000, you can trade $500,000 in forex or $100,000 in crypto. Always manage risks, as leverage amplifies both gains and losses. Learn more on our crypto trading page.

4. Are there AI tools to help with crypto and forex trading?

Absolutely. Giraffe Markets integrates AI-driven indicators on the MetaTrader 5 (MT5) platform, offering real-time analysis and automated trading signals for pairs like ETH/USD and GBP/USD. These tools reduce emotional bias and improve precision. Try them with our demo account.

5. Is Giraffe Markets regulated for crypto and forex trading?

While Giraffe Markets provides a robust trading platform, some sources indicate it may not be regulated by strict financial authorities. We recommend verifying the regulatory status before trading to ensure compliance and safety. Contact our support team for details.

6. How can beginners start trading crypto and forex with Giraffe Markets?

Beginners can open a demo account to practice risk-free, access our educational hub for tutorials, and use Giraffe Markets’ 24/7 support for guidance. Start with low-risk strategies like scalping or correlation trading to build confidence.

7. What global events should I watch for crypto and forex trading in 2025?

Key events include central bank rate decisions (e.g., Federal Reserve), crypto ETF approvals, and geopolitical developments. These impact forex pairs like USD/JPY and crypto prices like Bitcoin. Stay updated via Giraffe Markets’ market insights page.

Conclusion: Unlock Your Trading Potential with Giraffe Markets

The fusion of crypto trading and forex trading in 2025 offers unmatched potential. With Giraffe Markets, you can navigate both seamlessly—whether you’re scalping BTC/USD, riding a EUR/USD trend, or diversifying with gold. Open your live account or explore our crypto trading features to get started today.